Health insurance is a tedious, bureaucratic task but an essential item on every adult’s checklist. It helps them make sure they and their families can get proper care without incurring financial ruin.

Whether you’re looking for a policy or worried you’re not maximizing the benefits of the one you have, read on to learn how to get the most of your investment.

Plan Types

There are many health insurance approaches, and knowing what you need can help you avoid paying for more than necessary. Besides individual and family plans, there are others to understand and consider.

Health Maintenance Organization

This program delivers all services through its network of facilities. It doesn’t involve loads of paperwork, but you get very little freedom in choosing your doctors. Plus, you’ll need a referral from your primary care doctor to see a specialist.

Preferred Provider Organization

A PPO gives you more autonomy in selecting your doctors and doesn’t require you to get referrals. However, you can expect plenty of paperwork and out-of-pocket costs if you see specialists not involved in the network.

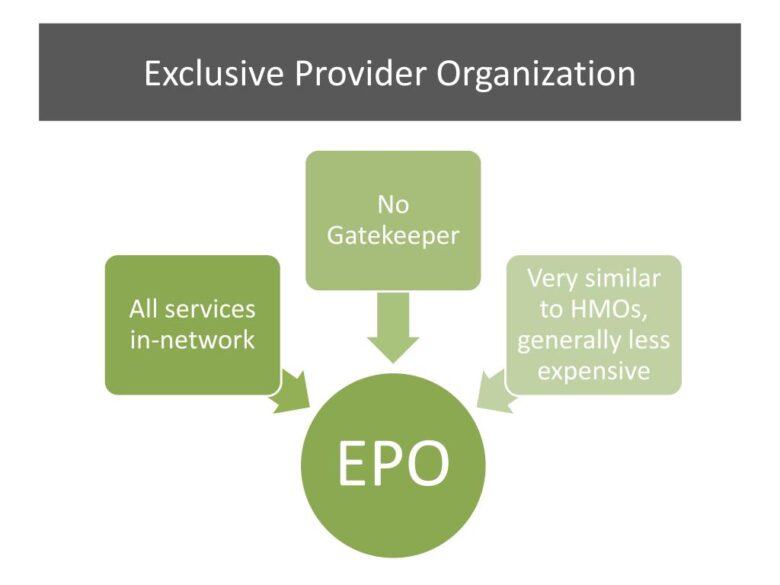

Exclusive Provider Organization

EPOs are similar to PPOs, with slightly lower premium costs. You can see any doctor in the system free of charge, but with no coverage for out-of-network ones except in an emergency.

Catastrophic Plan

Some people under 30 are eligible for this plan. It comes with a lower premium, three free primary care visits, and free preventative care before paying for your deductible.

Online Shopping

There are many insurers out there, and not all sell their plans through the government marketplace.

It might be a better idea to go to health insurance companies directly to get a broader selection of plans, especially if you’re finding the official ones too pricey or inadequate.

However, doing so makes it much more overwhelming to compare offers and decide on the best one. That’s where the Internet comes into play. After you determine your needs and budget, all it takes is some research to find a plan that suits you best.

You don’t even have to shop around on various websites. Online services that compare premiums for you and give you quotes exist, making an insurance purchase a swift and comfortable process.

Bonus tip: Some people might be uncomfortable with making such a necessary investment without face-to-face communication. If you’re interested but unfamiliar with the process, you can find out here how it works.

Job-Based vs. Private

If your employer offers a premium, chances are you should take it. It reduces the hassle of shopping around by yourself, and in general, the offer is good enough to accept.

However, it’s not always the case. There are situations where it’s much more beneficial for you to opt-out of the group insurance and go for an individual plan.

Most employers will pay for the part of the premium at least, but the amounts they subsidize vary, and sometimes, they might skip it altogether. If that’s the case, consider the costs and check whether it’d be more affordable to go solo.

The Affordable Care Act requires employers to cover at least 60% of the standard population’s medical expenses. However, if your situation is far from standard, you might end up paying for more by yourself.

Your boss could also offer too pricey plans, especially for employees with families. Again, check the market before you refuse, but do so if you find a better deal.

Finally, after you lose your job, the COBRA law allows you to continue using business insurance, but the employer no longer has to subsidize the premiums. Similar to the first case, you might want to look elsewhere.

Cost Reduction Tricks

According to Beamalife Even if you get an affordable plan and you’re satisfied with the costs involved, there are ways to reduce them even more with several simple tricks.

Most notably, out-of-pocket expenses decrease once you meet your deductible for the year. So, if it’s not urgent, wait before you max out to schedule pricey appointments and annual full-body checkups.

You might also be eligible for a rebate or a partial refund for your private health insurance. The government uses a means test and your age to determine eligibility.

Furthermore, your insurer might offer a subscription service for long-term medication. Taking up that offer reduces both the hassle and dispensing fees.

Perks and Benefits

Insurance companies are businesses that profit off you not getting sick. So, many of them offer a range of incentives and programs to improve customers’ health and well-being.

They partner with various businesses, from gyms to weight management programs, apps, and alternative treatment providers to help keep you healthy and themselves wealthy. Take advantage of the privileges.

Final Thoughts

Finally, remember to use your insurance. Your health is essential, and catching an issue sooner reduces the toll both on your wallet and general well-being. We hope this guide encouraged you to make the most of your premium and keep yourself safe.